PhysicsWallah IPO, When a homegrown edtech brand transforms from viral digital success to a publicly listed entity, it becomes a moment worth watching—and today, that spotlight sits squarely on PhysicsWallah, one of India’s most influential education platforms. With its listing scheduled for November 18, 2025, the excitement around the stock market debut is at an all-time high. Investors, analysts, and students alike are curious to see how the company performs as it steps into the world of publicly traded corporations.

In this comprehensive and conversational breakdown, we’ll explore everything from the GMP trends to market expectations, subscription numbers, expert commentary, and wha

PhysicsWallah IPO listing today shows strong GMP and investor interest. Get the latest updates on listing price, expert analysis, and market expectations.

The Big Day: PhysicsWallah Shares Hit BSE and NSE Today

After months of anticipation, the big moment has finally arrived. PhysicsWallah is officially making its move onto the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE). This marks the beginning of a new era for the brand, once known primarily for affordable online lectures and now recognized as a powerful force in India’s education industry.

The company’s IPO was open for subscription from November 11 to November 13, with the allotment finalized on November 14. According to a notification from the BSE, the stock will appear under the ‘B’ Group of Securities and participate in the Special Pre-Open Session (SPOS) beginning at 10:00 AM.

The Journey From YouTube to Dalal Street

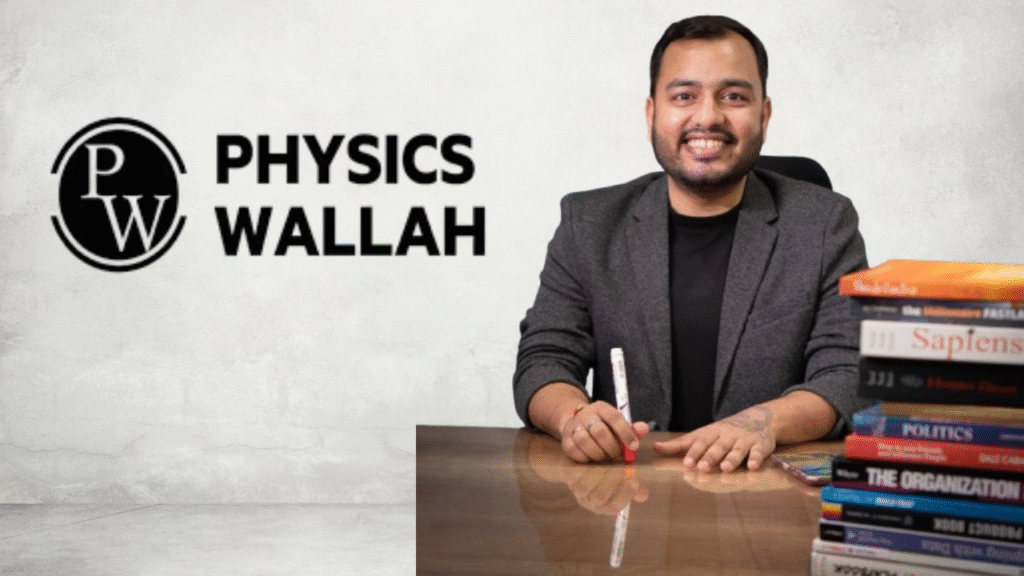

To truly appreciate today’s listing, you have to understand where PhysicsWallah started. Founded by Alakh Pandey, the company began as a YouTube channel dedicated to making high-quality education accessible to every Indian student. Over time, PW grew into a massive ecosystem that includes an app, offline coaching centers, test prep materials, and an expanding roster of instructors.

What makes this journey remarkable is not just the growth—it’s the loyal community behind it. Students in small towns and metro cities alike swear by the platform’s teaching style. This connection translated into skyrocketing revenues, scaling from ₹772 crore in FY23 to more than ₹3,000 crore in FY25. It’s rare for an edtech company to pull off numbers like these in such a short span.

PhysicsWallah IPO Details at a Glance

Even if you missed the subscription window, here’s a quick refresher:

| Detail | Information |

|---|---|

| IPO Open | November 11, 2025 |

| IPO Close | November 13, 2025 |

| Allotment Date | November 14, 2025 |

| Listing Date | November 18, 2025 |

| Issue Size | ₹3,480.71 crore |

| Fresh Issue | ₹3,100.71 crore |

| Offer for Sale (OFS) | ₹380 crore |

| Price Band | ₹103–₹109 per share |

The response was balanced—not oversubscribed to a crazy extent, but healthy enough to show investor confidence in the company.

GMP Signals Positive Sentiment Ahead of Listing

One of the most talked-about factors before any listing is the Grey Market Premium (GMP). Although unregulated, the GMP acts as a sentiment meter. It’s basically the whisper network of the stock market, reflecting how investors feel before the stock officially hits the exchanges.

Today’s GMP stands at ₹14 per share, meaning traders in the unofficial market are willing to pay ₹14 more than the upper price band of ₹109. This puts the estimated listing price at roughly ₹123 per share, suggesting a 13% premium over the issue price.

It’s not the kind of wild, triple-digit listing gain we saw during India’s historic IPO wave, but it’s a steady and reassuring premium—especially given that the edtech sector has been shaky over the last couple of years.

Expected Listing Price: Analysts Predict a Decent Premium

Market analysts agree that the stock is likely to enjoy a solid debut. If the GMP holds steady, the share may open in the range of ₹120–₹125. The actual number will depend on early morning demand, market conditions, and investor appetite.

Analysts also emphasize that the brand’s popularity and strong revenue growth could support its listing. However, they also caution that long-term performance depends on whether the company can eventually break out of its current pattern of losses.

Expert Commentary: A Turning Point for India’s Edtech Sector

Here’s where things get interesting. According to analysts, the listing isn’t just about price movements—it’s about the future of Indian edtech. Bhavik Joshi, Business Head at INVasset PMS, summarized it perfectly:

“PhysicsWallah’s IPO represents a defining moment for India’s edtech sector, marking a shift from digital virality to institutional scale. The company’s rapid revenue expansion shows strong brand momentum. But profitability remains elusive, with cumulative losses of more than ₹1,400 crore between FY23 and FY25. This IPO is essentially a long-term bet.”

This commentary highlights a reality investors must accept: PW is growing fast, but it’s burning cash fast too.

Subscription Status: Who Showed Confidence?

The IPO received a total subscription of 1.81×, according to NSE data.

Let’s break it down:

- Retail Individual Investors (RIIs): 1.06×

- Non-Institutional Investors (NIIs): 0.48×

- Qualified Institutional Buyers (QIBs): 2.70×

The strong QIB participation is reassuring because institutional buyers usually study fundamentals more deeply than retail investors. Their involvement often signals confidence in long-term business potential.

Why the Edtech Sector Is Watching Closely

Edtech companies across India are monitoring this listing closely. The sector has experienced ups and downs—from massive funding rounds to sharp valuation cuts and widespread restructuring.

PhysicsWallah stands out because:

- It built a massive student base organically.

- It has strong penetration in Tier 2 and Tier 3 cities.

- It scaled offline coaching rapidly.

- Its pricing model focuses on affordability.

The PhysicsWallah IPO (keyword use #1) is more than a listing—it’s a test case for whether Indian edtech can regain investor trust.

Can PhysicsWallah Deliver Long-Term Value to Investors?

To understand this, let’s look at the strengths and risks.

Strengths

- Brand Loyalty: One of the strongest in India’s education space.

- Revenue Growth: From ₹772 crore to ₹3,000+ crore in two years.

- Hybrid Model: Online + Offline expansion.

- Market Reach: Deep penetration into smaller cities.

Weaknesses

- Significant losses in recent years.

- High competition from both edtech and offline coaching giants.

- Continuous need for capital to maintain offline centers.

Opportunities

- New exam categories

- Wider offline expansion

- Digital subscription models

- International markets

Threats

- Changing exam patterns

- New government regulations

- Price wars with rivals

Investors should see this not as a quick win but as a long-term growth story. The PhysicsWallah IPO (keyword use #2) is essentially a bet on India’s education demand and PW’s ability to convert brand love into sustained profits.

GMP, Sentiment & The Road Ahead

As of today, sentiment remains optimistic. A rising grey market premium typically indicates higher demand upon listing. If investors feel the company can pivot toward profitability while maintaining its growth, the listing could mark the beginning of a strong market journey.

The PhysicsWallah IPO (keyword use #3) is one of the most anticipated events of 2025, especially for those who’ve watched the brand grow from humble beginnings to a nationwide powerhouse.

Should You Invest on Listing Day?

This is the big question. And while there’s no one-size-fits-all answer, here’s a balanced view:

Why Investors Might Consider Buying:

- Expected listing premium

- Strong institutional interest

- Powerful brand identity

- Rapid growth trajectory

Why Investors Might Stay Cautious:

- Heavy losses

- Valuation concerns

- Sector volatility

- Competition from emerging players

Ultimately, the decision depends on whether you believe in the company’s long-term vision. The PhysicsWallah IPO (keyword use #4) is not a short-term story—it’s a multi-year commitment.

What the Listing Means for the Industry

This event sends a strong signal about the resilience of India’s edtech sector. Despite the turbulence of the last few years, a successful listing could spark renewed investment in similar ventures.

It’s proof that their beloved platform is evolving. For founders, it’s inspiration that digital-first brands can become stock-market successes. For investors, the PhysicsWallah IPO (keyword use #5) is a test of whether the intersection of education and tech still holds long-term promise.

Read More: PSU Bank Merger News: Why Public Sector Bank Stocks Are Rallying Up to 4%

Conclusion

The journey of PhysicsWallah from a single YouTube channel to one of India’s most awaited stock listings is nothing short of remarkable. With a positive GMP, steady subscription numbers, and strong institutional backing, the company seems poised for a respectable debut on the BSE and NSE.

While profitability remains a concern, the brand’s impact, reach, and growth trajectory make it an investment that requires patience and long-term vision. Whether you’re watching out of curiosity or planning to invest, one thing is clear—the PhysicsWallah IPO (keyword use #6) marks a powerful milestone for Indian entrepreneurship and the future of edtech.