When dealing with structured settlements, recipients may sometimes encounter interactions with companies acting as debt collectors related to the structured settlement payments. Understanding what a structured settlement company debt collector is and how they operate is vital for protecting your rights and financial interests.

This comprehensive guide explains the role of debt collectors in the context of structured settlements, your legal protections, how to handle collector communications, and provides trusted business resources for assistance.

What Is a Structured Settlement Company Debt Collector?

A structured settlement company debt collector is an entity that attempts to collect debts or payments tied to structured settlements. This can arise when a structured settlement payment has been assigned or sold, creating financial obligations or when disputes over payment amounts or schedules occur.

These companies may contact you to collect outstanding balances, negotiate repayment plans, or enforce court-approved sales or transfers of structured settlement payments.

It is important to differentiate between a company managing your structured settlement payments and a debt collector who engages when there are payment conflicts or outstanding debts associated with your settlement.

Why Do Debt Collectors Get Involved with Structured Settlements?

-

Sale of Structured Settlement Payments: If a recipient has sold their payment rights to a third party (a purchase company), the debt collector may act on behalf of the purchaser, seeking to collect payments or enforce the assignment.

-

Repayment of Advances: Sometimes, companies advance lump sums to recipients against future structured settlement payments. If terms are not met, debt collectors may get involved.

-

Disputes or Defaults: In cases where collection or payment disputes arise regarding the structured settlement, debt collectors may be called to resolve matters.

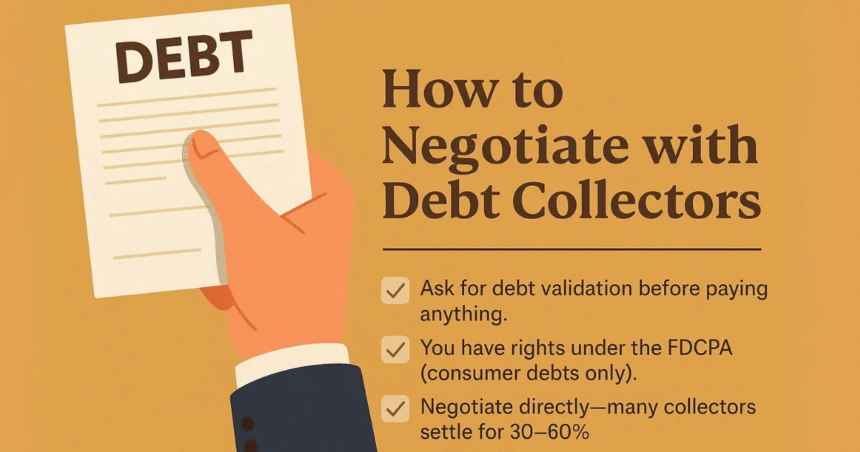

Your Legal Rights Against Debt Collectors

Under U.S. law, specifically the Fair Debt Collection Practices Act (FDCPA), debt collectors must follow strict rules to protect consumers, including those with debts related to structured settlements.

Key Protections Include:

-

Debt collectors cannot harass, threaten, or abuse you.

-

They must identify themselves and provide details about the debt.

-

You have the right to request verification of the debt.

-

Collection efforts must stop if you dispute the debt in writing.

-

They cannot collect more than what is legally owed.

Understanding and asserting these rights is essential when dealing with structured settlement debt collectors.

How to Handle Communications from Structured Settlement Debt Collectors

1. Verify the Debt and Collector

Request the company’s licensing information, proof of debt ownership, and ensure their legitimacy.

2. Keep Detailed Records

Document all communications, including dates, times, and content of conversations and letters.

3. Know Your Rights

If the collector violates FDCPA rules, you can file complaints with the Consumer Financial Protection Bureau (CFPB) or seek legal assistance.

4. Avoid Sharing Sensitive Information

Do not provide financial or personal data over the phone unless you verify the legitimacy of the collector.

5. Seek Professional Advice

Contact a consumer protection attorney or financial advisor familiar with structured settlement issues to guide you.

How to Identify Legitimate Structured Settlement Debt Collectors

-

They provide clear, written information about the debt.

-

Are licensed and regulated in your state.

-

Do not use aggressive or abusive tactics.

-

Respect your rights to dispute the debt.

-

Comply with court orders related to the structured settlement.

Business Listing: Trusted Resource for Debt Collection Issues

For assistance navigating structured settlement debt collection and protecting your rights, turn to The Consumer Financial Protection Bureau (CFPB) — a federal agency dedicated to protecting consumer financial interests.

Visit the CFPB’s official website at https://www.consumerfinance.gov to file complaints, learn about your rights, and access educational tools to handle debt collectors legally and effectively.

Tips to Protect Yourself from Debt Collector Abuse

-

Never ignore debt collector communications—respond promptly but cautiously.

-

Ask for all agreements in writing before making payments.

-

Be aware of your state laws on debt collection practices.

-

Contact local consumer protection offices if you feel harassed.

-

Always review structured settlement contracts thoroughly before selling payments to avoid future collection conflicts.

What to Do if You Face Problems with a Structured Settlement Debt Collector

-

Contact the seller or original structured settlement company for clarification.

-

Seek mediation or legal intervention if disputes escalate.

-

Consider consulting nonprofit credit counseling agencies.

-

Report persistent violations to the CFPB or your state attorney general.

Read More: Best Structured Settlement Companies: Top Choices for Settlements in 2025

Final Thoughts

While structured settlement company debt collectors play a role in managing debts related to settlements or payment sales, it is crucial to recognize your legal protections and handle communications carefully. Staying informed, documenting interactions, and seeking professional advice can help you protect your rights and navigate debt collection responsibly.

For anyone dealing with debt collectors in the structured settlement space, relying on credible resources like the CFPB ensures consumer protections are upheld, and fair practices are followed.